Understanding business expenses is crucial for effective financial management. Business expenses encompass the costs a company incurs to operate smoothly, from employee salaries to office supplies and rent. By identifying the four types of expenses, businesses can gain valuable insights into managing their finances more effectively.

These costs are listed on the company’s income statement, which reflects how much money is coming in from sales and how much is going out in expenses. Properly identifying and categorizing expenses helps businesses plan and track their financial activities. Subtracting expenses from income determines the company's profit, which is essential for accurate tax calculations. This blog focuses on identifying the four types of expenses, clarifying where a company’s money goes, and highlighting their importance.

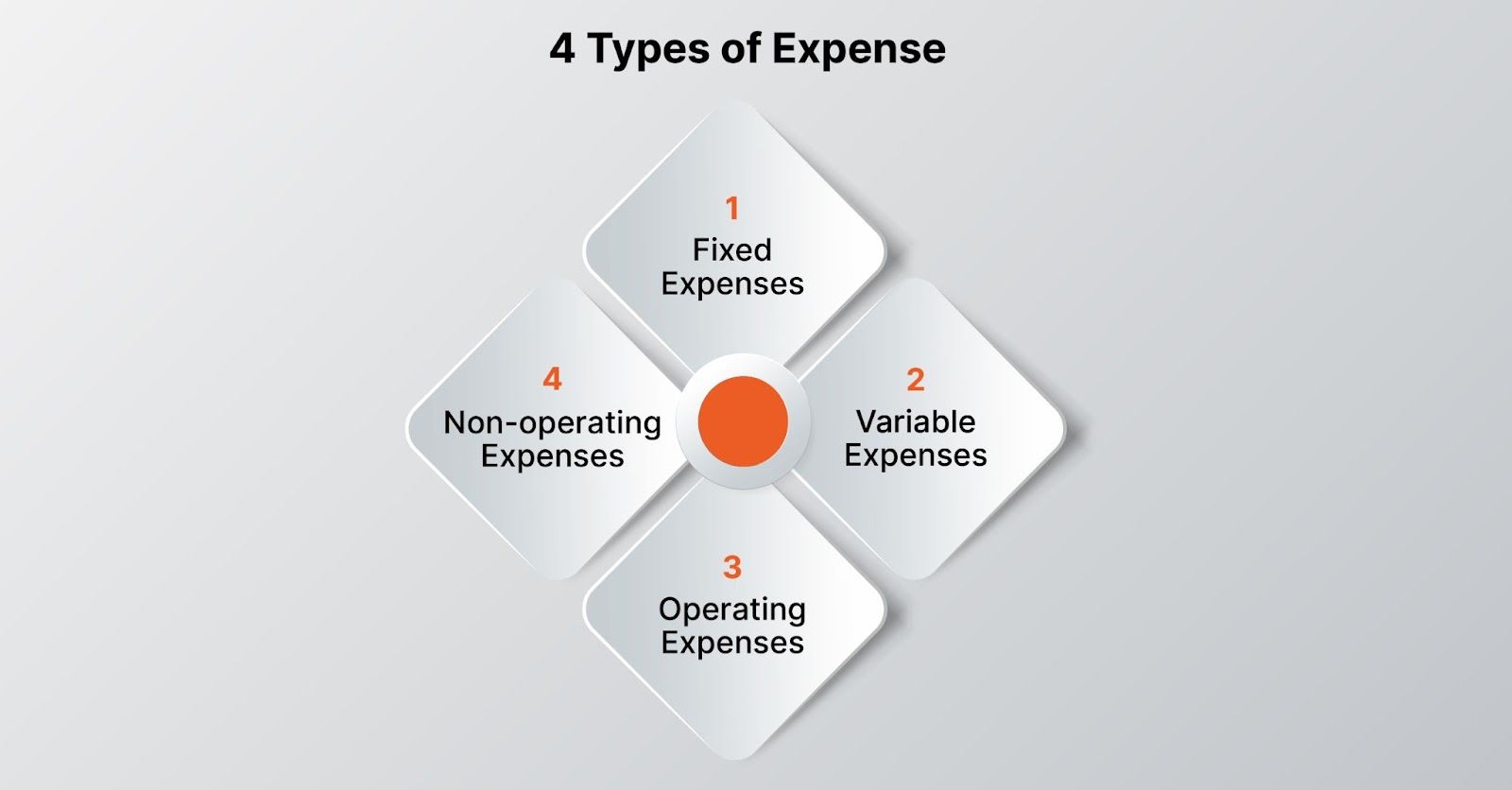

What Are the 4 Types of Expenses?

Understanding the four types of business expenses helps in planning and managing a company's financial health. These expenses are:

- Fixed Expenses

- Variable Expenses

- Operating Expenses

- Non-operating Expenses

Fixed Expenses

Fixed expenses are steady costs that remain constant regardless of a business's sales or production levels. These expenses are contractual or scheduled and do not fluctuate with business activity. Fixed expenses include:

- Rent: Regular payments for leasing office space, retail space, or manufacturing facilities.

- Salaries and Wages: Base salaries and fixed wages for employees and contracted workers.

- Insurance Premiums: Payments for property, liability, or health insurance.

- Loan Payments: Monthly installments for business loans, including mortgages and equipment loans.

- Depreciation: The gradual decrease in asset value over time.

- Utilities: Costs for essential services like electricity, water, gas, and internet.

- Lease Payments: Payments for leasing equipment or vehicles.

Fixed expenses are predictable and essential for budgeting, providing a stable financial foundation for the business.

Variable Expenses

Variable expenses fluctuate based on the company's production and sales levels. These costs increase with higher production and decrease with lower production. Key examples of variable expenses include:

- Raw Materials: Components needed to produce goods.

- Labor: Wages for workers involved in production and sales.

- Utilities: Costs for essential services, which can vary with usage.

- Commission: Payments to salespeople based on sales performance.

- Distribution Costs: Expenses related to shipping and delivering products.

- Packaging Materials: Costs for packaging products.

- Marketing Expenses: Costs associated with advertising and promotions.

Variable expenses are crucial for calculating a product’s contribution margin and understanding the profitability of increased production.

Operating Expenses

Operating expenses are the regular costs of running a business. These include:

- Salaries and Wages: Payments to employees.

- Rent: Leasing costs for business premises.

- Utilities: Essential services like electricity, water, and internet.

- Office Supplies: Everyday supplies needed for business operations.

- Insurance Premiums: Regular payments for various insurance coverages.

- Marketing and Advertising: Costs for promoting the business.

- Maintenance and Repairs: Expenses for keeping equipment and facilities in working order.

- Travel Expenses: Costs for business travel.

- Professional Fees: Payments for legal, accounting, and consulting services.

Operating expenses are essential for daily business functions and are typically tax-deductible, reducing the company's taxable income.

Non-operating Expenses

Non-operating expenses are costs not directly related to the core business operations. These include:

- Write-offs: Accounting for unrecoverable debts.

- Restructuring Costs: Expenses related to reorganizing the company.

- Legal Settlements: Payments for resolving legal disputes.

- Interest Expense: Costs of borrowed funds.

- Foreign Exchange Losses: Losses due to currency fluctuations.

- Impairment Charges: Write-downs of asset values.

Non-operating expenses provide a clearer picture of a company’s financial performance by separating one-time costs from regular operations.

Identifying the Four Expense Types for Enhanced Financial Analysis:

Understanding and categorizing the four types of business expenses is vital for effective financial analysis and management. Businesses can optimize spending, enhance financial planning, and improve profitability by clearly distinguishing these expenses.

With airretailer expense management software, managing your company’s finances becomes simpler and more efficient. Airretailer offers real-time visibility into spending, making it easy to track and categorize expenses. This advanced tool empowers businesses to take control of their finances, optimize spending, and boost their bottom line. Experience the simplicity and power of airretailer today. Reserve your spot for a free demo and transform your financial management.